I raise my cup of espresso to the FCC for starting the process to reform the Universal Service Fund with the ultimate goal of modernizing a rusting regulatory structure that is not up to task of universal broadband service.

I raise my cup of espresso to the FCC for starting the process to reform the Universal Service Fund with the ultimate goal of modernizing a rusting regulatory structure that is not up to task of universal broadband service.

Reading the beginning of the FCC’s recent Proposed Rule Making on the USF, I was all to ready to discount the glib appraisals of the Service Fund as “inefficient” and “broken”. Sure it’s not perfect, I thought, and of course there are loopy incentives encouraging some inefficient activities, but…

A dispute between XO Communications, “one of the nation’s largest communications service providers”, and the Fund’s administrator, the Universal Service Administration Corporation or USAC, unfortunately seems to validate some of the harsh criticisms hurled at the current USF regime.

It has all the makings of an on-the-edge-of-your-seat FCC caper: battling attorneys, hyper-diligent auditors, endless bureaucratic procedures, ambiguous forms, battling attorneys, and battling attorneys.

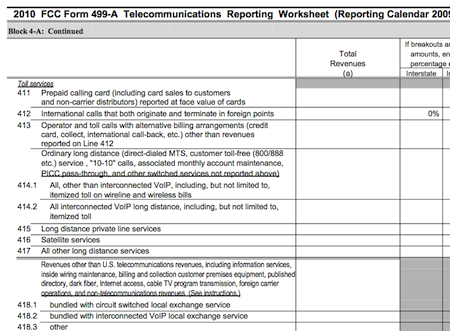

In July 2008, USAC initiated an audit of XO’s $1.4 billion in revenues as reported on the FCC’s Form 499-A.

Yes, this is the same Form 499-A in which a not very well publicized change related to conferencing services revenues caught a few companies off guard (see InterCall ruling below).

In their 195-page draft, completed in December 2009, the USAC auditors reproduced their own Form 499 report, based on a different interpretation of what revenues should count towards the universal service fund pool.

Then XO tried to recreate USAC’s 499-A numbers, based on the auditor’s own methodology, which resulted in a 56-slide PowerPoint that it presented with an explanation of errors and inconsistencies it found. At this point, you almost want to start in with a verse of Alice’s Restaurant.

19th century form for 21 century world.

The USAC board finally approved the XO audit in November 2010. Soon after XO filed a request for review with the FCC.

And here we are are in 2011, and things are just picking up steam.

XO’s review request and comments from other parties with similar USAC issues are filed for you reading pleasure under a Wireline Competition docket #06-122.

One of XO’s main gripes is that USAC has re-classified revenue from some of its private line services— point-to-point copper lines or fiber loops strung between different business locations—as “interstate”.

Formerly this private line revenue was parked under the intrastate box, and XO paid into state level service funds. The difference between interstate USF payment rates versus a state’s internal service fund formula is significant, according to XO, though the exact amount has been redacted in the filings.

On this one you have to sympathize with the carrier. XO argues that multi-location business, schools, etc. with endpoints that are physically intrastate and have been configured to be closed off should receive a presumption of intrastate status.

The outside attorneys who wrote XO’s filings are persuasive.

I won’t go into all the differences between XO and USAC—involving the FCC’s “10% rule”– but the two are so at at odds with each other that if one is right, the other is really, profoundly wrong.

And it is both amusing and appalling to read the parties discuss the meaning of some fine print instructions in this darn form. Note to USAC: move to a spreadsheet.

However … I think I see where USAC is going. Of course, customers of XO’s Dedicated Transport Services, its name for its private line services, are making (predominantly) on-net calls, but what about off-network calls to the rest of the world?

While the XO says these disputed networks are “closed”, it must, I would think, allow phone calls to POTS. So USAC wants to count, in some manner, revenue derived from the voice stream that leaves office A destined for some number in the public phone network.

However, XO swears that its customers claim that the traffic is 100% internal. The auditors feel differently. And the FCC will decide the matter.

Soon, I hope.