One of the remarkable things I learned talking to Yaron Samid, co-founder and CEO of BillGuard, is the level of credit card fraud that’s publicly reported on the Web.

Currently in beta, BillGuard has a mission to catch both unwanted and unauthorized credit transactions—there’s a difference—based on crowdsourced input from its subscribers.

As with a lot of companies that rely on the crowd, BillGuard faced a cold start problem: with few signed up to review and mark questionable charges, there’s little data.

BillGuard cleverly solved it by mining Twitter, consumer complaint forums, and other sites. For kicks, search Twitter for “credit card fraud” and prepare to be surprised

And you know what, according to Samid, they achieved a 20% hit rate matching complaints against vendors culled online with credit transactions from their existing pool of subscribers.

Those who attended TechCrunch Disrupt NYC in May, may have remembered Samid and his presentation at the Battlefield Finals, where his company narrowly lost to a San Francisco startup whose name, ahem, escapes me.

Since their launch two and a half months ago at Disrupt, Samid told me during a phone call that BillGuard has been able to save $337,000 for users with its current hybridized approach of external sources along with their own software analysis.

As time goes by, though, each user click on a transaction makes their own internal data more valuable.

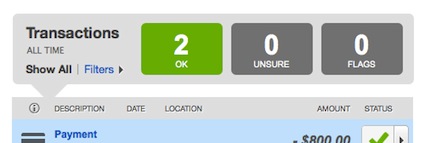

Users alert BillGuard of questionable transactions

Another remarkable result that came out of their early testing is that a lot of flagged transactions are associated with legitimate vendors.

Said Samid: “We’re finding somewhere over 70 to 75% of these transactions are from legitimate merchants whose billing practices have caused people to be either misled or forget about being charged by them. So we find lots of recurring subscriptions that the system has identified as … unwanted. We don’t mark it as fraud we mark it as unsure.”

These unwanted charges are usually subscription fees or recurring charges that the user has forgotten about or more likely didn’t realize the full cost. Samid discovered there was a science behind what these merchants do to make you not realize how much you’re actually paying.

Right before our conversation, I signed up for the BillGuard service—it’s pretty quick to do—and had it connect with and scan charges from one of my lightly used credit card accounts. I was given a clean bill of health. But if I had noticed anything unusual, I could mark a charge as “unsure” or if I was more suspicious, flag it as an error.

Unwanted charges are annoying, but unauthorized charges obviously cross the line into illegality. While less frequent, the dollar amounts are significant. Samid said the largest unauthorized charge BillGuard discovered was just over $30,000. More insidious are the virus-like frauds involving easy to overlook micro-charges that will show up on lots of credit card holders’ statements.

Yaron Samid at TC Disrupt

Samid: “It’s actually some hacker who’s gotten credit cards from some breach … These merchants are very sophisticated: they get a merchant account, billing address, phone number, a very legitimate sounding name, a great looking website, and they run $5.35 on thousands of cards.”

It turns out that this death-by-a-thousand-cuts fraud is easier to detect with BillGuards’ crowdsourced approach. Since so many are affected, there’s a good chance someone will notice and report it to BillGuard through the app, thereby alerting the rest of the community.

What’s ahead for BillGuard? They see opportunity and value in the backend data they are growing and cultivating. So much so that their business model is now based on giving the service away for free to consumers: this is not a free as in freemium, but just plain free.

Samid told me that because of “their surprising reception from banks” they realized they can help them and the credit card companies by weeding out bad merchants, who cause excessive processing fees and ultimately end up raising commissions for better-run businesses. For this kind of cost saving, banks will pay to have BillGuard as a service integrated into their systems.

Further down the road, Samid wants BillGuard to be— you heard it here —a public company, “the Symantec of personal finance security”. And ultimately they will become one of the look-up resources used by credit card companies at the point-of-sale to determine whether to authorize a charge.

Hey, Yaron and BillGuard, can you get this software to look into the mortgage industry next?

Related articles

- Website Tracks Nuisance Charges and Worse (blogs.nytimes.com)

- TechCrunch Disrupt: The End (technoverseblog.com)

- BillGuard